Australian Unity Diversified Property Fund sells industrial asset in Richlands, Queensland for $85m

Contact

Australian Unity Diversified Property Fund sells industrial asset in Richlands, Queensland for $85m

Australian Unity’s Diversified Property Fund has finalised the sale of an industrial property at 278 Orchards Road, Richlands, Queensland for $85 million. Ms Nikki Panagopoulos, Fund Manager, Diversified Property Fund, said the sale capitalised on the market’s strong demand for well- located industrial assets with investors benefitting from Australian Unity’s active management and the diversification of the Fund’s direct property portfolio.

Australian Unity’s Diversified Property Fund has finalised the sale of an industrial property at 278 Orchards Road, Richlands, Queensland for $85 million. Ms Nikki Panagopoulos, Fund Manager, Diversified Property Fund, said the sale capitalised on the market’s strong demand for well- located industrial assets with investors benefitting from Australian Unity’s active management and the diversification of the Fund’s direct property portfolio.

The warehouse and industrial site owned by the Fund since its inception in August 2006, settled on 5 March 2021 at a premium to its prior book valuation.

Ms Nikki Panagopoulos, Fund Manager, Diversified Property Fund, said the sale capitalised on the market’s strong demand for well- located industrial assets with investors benefitting from Australian Unity’s active management and the diversification of the Fund’s direct property portfolio.

“Industrial property, which currently comprises about 17% of the Fund’s direct property portfolio, has been a stand-out performer since the onset of the pandemic, with demand for warehousing space surging to unprecedented levels in line with growth in e-commerce.” Ms Panagopoulos said.

“The sale of the Richlands property has increased the weighted average lease expiry of the Fund to circa 8.3 years from 8.1 years and augments the Fund’s robust total returns. For the calendar year to 28 February 2021 the Fund’s total return was 19.72 per cent which comprised an income distribution return of 10 per cent”, Ms Panagopoulos said.

Three of the Diversified Property Fund’s properties were independently valued in February 2021, resulting in a $1.26 million or 1.30% overall increase in the portfolio’s book value. The revaluations of Woodvale Boulevard Shopping Centre and Busselton Central Shopping Centre in Western Australia and 19 Corporate Avenue in Rowville, Victoria bring the total value of the Fund to $544 million, post settlement of the Richlands property.

Ms Panagopoulos said the uplift in value for the Fund’s Western Australian assets was the result of strong economic conditions which continued unabated despite the pandemic, with the Fund’s industrial asset in Rowville benefiting from an active transactional market.

“Overall, the Diversified Property Fund’s exposure to defensive tenants – from supermarkets and convenience retailers to warehousing across metropolitan and non-metropolitan markets — supported the delivery of stable and consistent returns to investors, despite a challenging twelve months,” Ms Panagopoulos said.

“Our focus for 2021 is to continue to execute on our strong neighbourhood shopping centre development pipeline, while identifying acquisition opportunities for assets that deliver the services our communities need.”

Investors in the Fund will receive a special capital distribution as a result of the sale, which will be paid with the Fund’s regular, monthly income distribution payment in July 2021.

As reported in The INDUSTRIALIST 5 November 2019:

Asian food distributor and wholesaler expands warehouse space in Brisbane | The Industrialist

Property details:

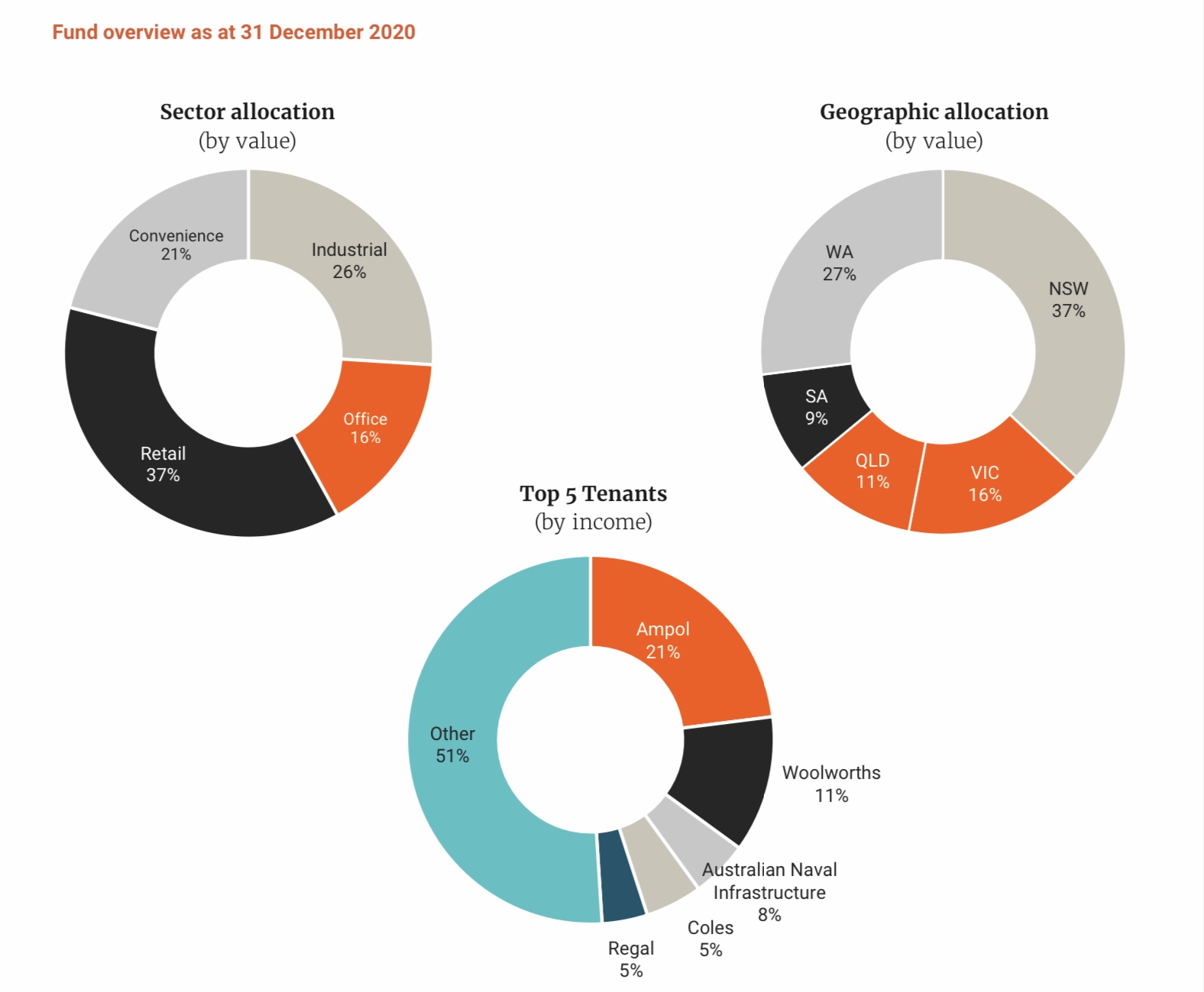

(As at 31 December 2020 source Australianunity.com.au)

- Lettable Area (sqm) 53,000

- Major tenant Myer

- No. of Tenants 4 (Myer, MCM Logistics, which is occupying 7000 square metres, and Flexitech Group, which has leased 6,500 square metres. KOZ Worldwide entered a lead in late 2019 to occupy 7,626 square metres)

- Occupancy Rate by income (%) 63.2

- Weighted Average Lease Expiry by income (years) 4.3 years

Source Australianunity.com,au - Book Value ($m) 61.72 (as at 31 December 2020)

.