“Just in case” supply chain strategies mean retailers need bigger sheds

Contact

“Just in case” supply chain strategies mean retailers need bigger sheds

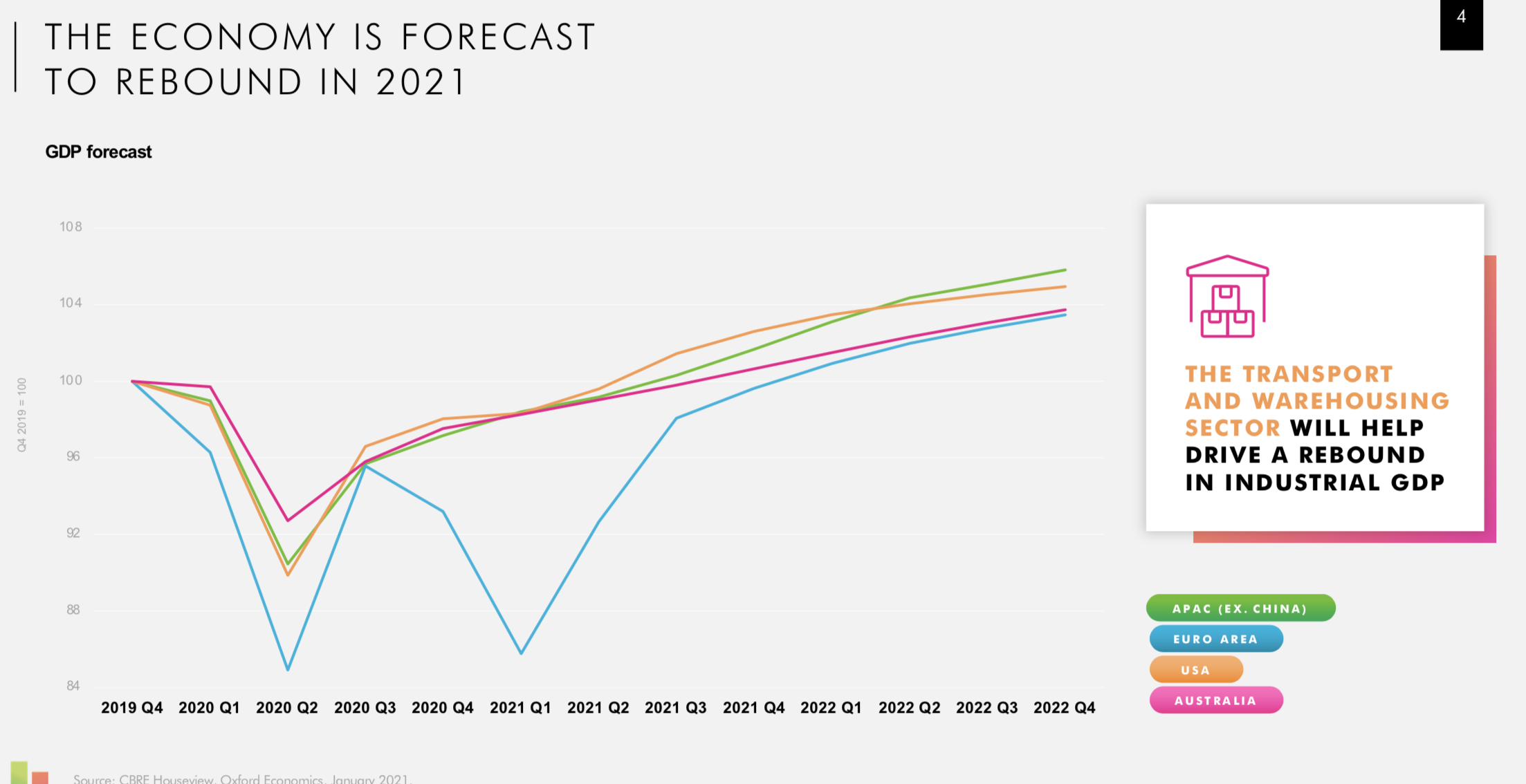

Industrial & Logistics (I&L) operations have had to flip the script in the past year, with retailers swapping out “just in time” supply chain principals for “just in case” inventory strategies and building their footprints.

Industrial & Logistics (I&L) operations have had to flip the script in the past year, with retailers swapping out “just in time” supply chain principals for “just in case” inventory strategies and building their footprints.

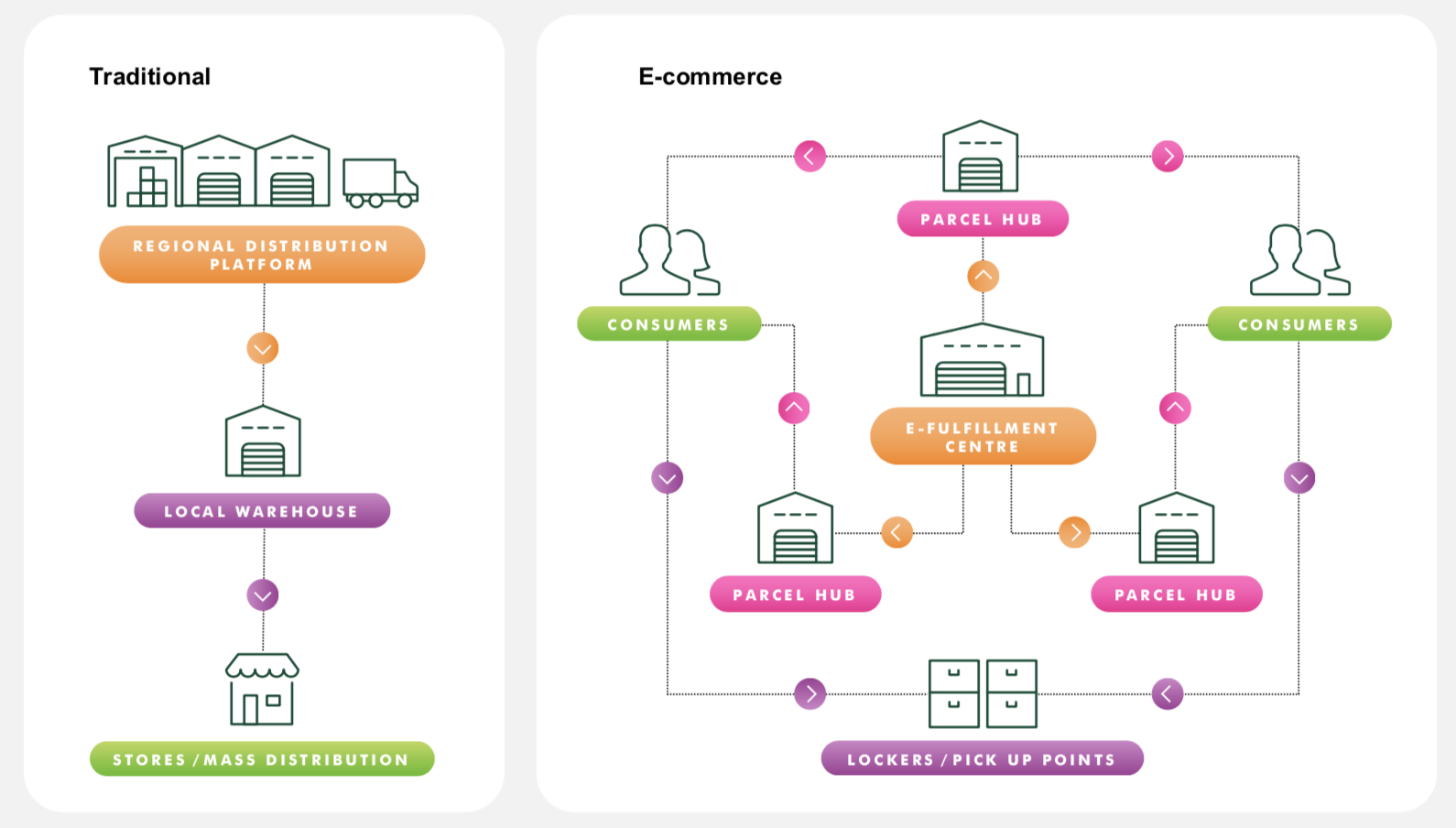

Operations for online order fulfillment require three times the amount of space as a store fulfillment operation – this fact, coupled with the inventory factor, is driving strong demand.

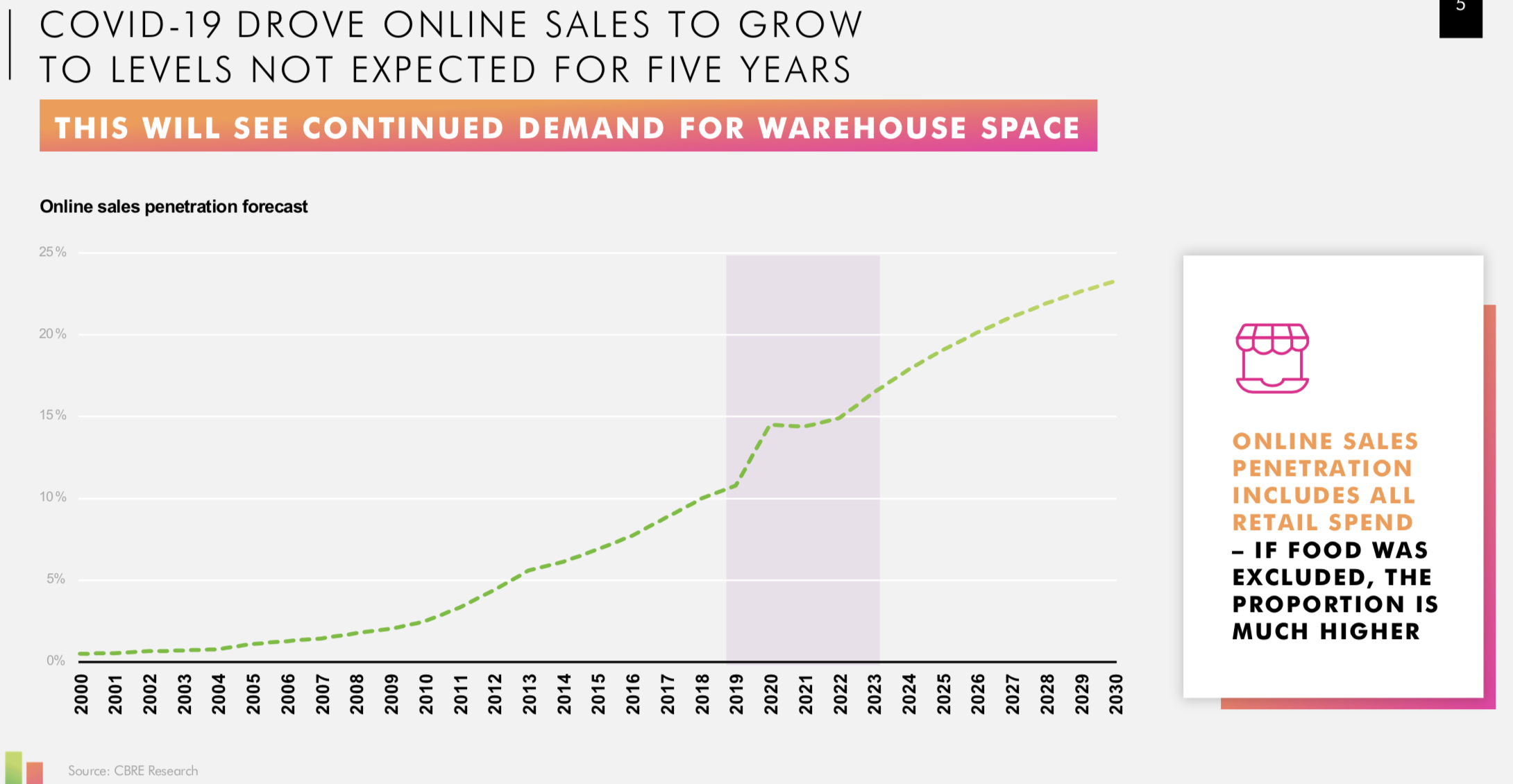

In its 2021 Australia Real Estate Market Outlook Report, CBRE Research explored how e-commerce was supercharging I&L enquiry levels – with an additional 350,000sqm of new space needed annually to keep pace with online sales activity in Australia.

CBRE’s Cameron Grier said that previously, occupiers were warehousing just enough stock to meet market supply at the time, which required a smaller footprint – however, since the onset of COVID-19, suppliers have moved to secure larger footprints to accommodate for a new wave of supply chain modelling.

“We are already seeing the average occupier warehouse footprint increasing to account for a wide-ranging rethink of inventory strategy, after many groups were caught with not enough stock during the pandemic,” Mr Grier, regional director of CBRE Pacific’s I&L – Investor Leasing business, continued.

Given approximately 40% of speculative developments were placed on hold last year, Western Sydney provides the perfect case study for how changing consumer behavior and pumped up supply chain networks are feeding huge demand for warehousing space.

In the past three months, deals negotiated by CBRE’s Western Sydney team include 11,894sqm at a Dexus estate in Eastern Creek to Independent Living Specialists (ILS); 12,445sqm in Eastern Creek to Amber Tiles; 27,000sqm in Regents Park to Quatius Logistics; 10, 000sqm in Arndell Park to Bell Solar and 6,047sqm in Eastern Creek to Alspec (both owned by Goodman). The team also has over 100,000sqm in signed Heads of Agreement stage, which will be finalised imminently.

“I haven’t seen this level of leasing enquiry in nearly 20-years – almost every vacant building has two to three runners and intense demand for warehousing space, which has pushed core vacancy on the East Coast to 1.6% and is expected to be sub-1% in many key markets towards the end of the year,” Mr Grier said.

“With vacancy so tight, I would liken the speed and enquiry level of I&L transactions to that of a residential market, with campaign conditions almost matching those of auctions.”

Kate Bailey, head of I&L research for CBRE, said that based on upward trending sales forecasts, the sector would see heightened demand for quality, well-located warehouse space.

“Traditional warehousing will continue to be sought after, but we can also expect to see an influx of last mile hubs, repurposed retail facilities and parcel lockers, given learnings from recent supply chain bottlenecks and a general maturing of the e-commerce trade in Australia,” Ms Bailey commented.

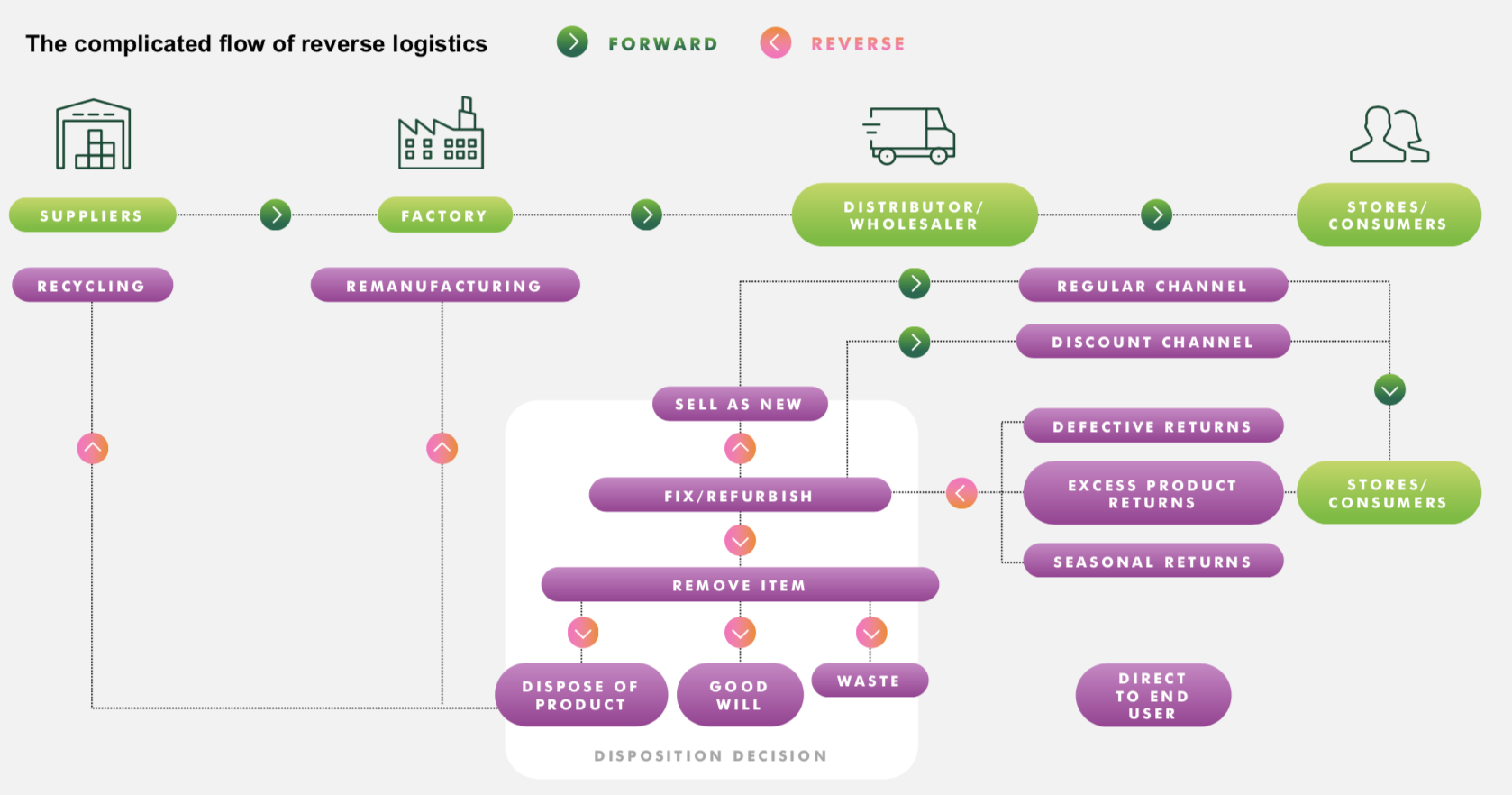

On the back of continued e-commerce success, space requirements for reverse logistics supply chain is expected to add to this demand, with the practice requiring circa 20% more space and labour capacity than when compared with forward logistics.

Mr Grier added; “The type of products being returned drive the real estate requirements and space criteria with secondary grade facilities being suitable for reverse logistics.”

“Lower ceiling heights are more appropriate since the activities within the space are high touch with slower processing and the varying size of the pallet loads makes them difficult to stack or safely store in high racks,” he continued.

“Reverse logistics is creating opportunities for many Third Party (3PL) operators, which drive large volume of demand for industrial real estate.”

“A positive returns policy is a competitive differentiator for retailers to retain customers – so, getting the reverse logistics equation right is critically important.”

The report also highlighted that I&L sales comprised 38.3% of all real estate transactions in 2020 – a record proportion of sales – with momentum expected to continue in 2021 as more groups seek to reweight their portfolios to capitalise on increasing occupier demand.

Click here to view and download the report.

Similar to this:

Industrial & Logistics assets top buyer wish lists, with ESG another key focus area says CBRE

Tight vacancy underpinning strong east coast industrial and logistics performance in 2020 - CBRE