Warehouse depreciation - BMT Tax

Contact

Warehouse depreciation - BMT Tax

Due to a behavioral shift in online shopping, the demand for commercial warehouses has increased dramatically says BMT Tax Depreciation.

In fact, CBRE research indicates that over the next couple of years 490,000 square meters of new warehouse space will be required to keep up with the accelerated growth rate of online shopping.

This growth has led warehouses to become a popular addition to many commercial investors’ property portfolios in recent years. Warehouses also offer attractive tax deductions in the form of depreciation.

Depreciation is the natural wear and tear of a property and the assets within it over time. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim this depreciation as a tax deduction.

There are two types of depreciation available on commercial properties. Capital works (Division 43) is the building’s structure and the permanently fixed assets. And plant and equipment (Division 40) are assets that are easily removable from the property or mechanical nature.

Some people have the mistaken belief that if an owner is not occupying their warehouse, they can claim capital works only – and not plant and equipment deductions. This is not true. While capital works make up majority of depreciation deductions there are still lucrative plant and equipment deductions available that commercial property owners are entitled to claim.

Some common plant and equipment deductions within a warehouse include exit signs, smoke alarms, blinds, shelving and carpet and flooring.

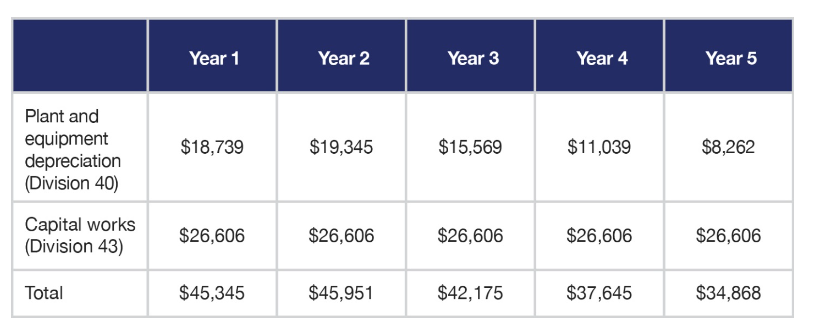

The following case study outlines the available capital works and plant and equipment depreciation deductions within a warehouse.

Case study – Depreciation available in a warehouse

‘Warehouse 1’ is a ten-year-old warehouse operating in Sydney. It’s 800 square meters with an office and breakroom. It was purchased in 2018 for $2,635,000 and the owner has long- term tenants renting the space.

The table demonstrates the five-year cumulative deductions found in Warehouse 1. As we can see there are substantial depreciation deductions available in both capital works and plant and equipment depreciation.

.

.

Even though the owner doesn’t occupy the space, there are still considerable plant and equipment deductions available.

Claiming depreciation helps boost cash flow. The owner of Warehouse’ is entitled to claim $45,345 in depreciation deductions in the first year alone and more than $205,000 over the first five years.

It’s important to note that all tax depreciation schedules are 100 per cent tax deductible. BMT Tax Depreciation are the experts in helping their clients claim maximised and fully complaint depreciation deductions. Their commercial process has been optimised to ensure clients claim the most deductions possible.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

To learn more about warehouse depreciation call or to speak to depreciation specialist call BMT on 1300 728 726 or Request a Quote.